We understand the wait after applying for a new credit card can be stressful. You’re eager to know if your AU Bank credit card application was approved. But fret no more! Here’s a quick and easy solution to check your status online in just a few minutes. This guide focuses on the most convenient method: using your Lead ID and PAN.

1 Step: Head to the AU Bank Application Status Tracker

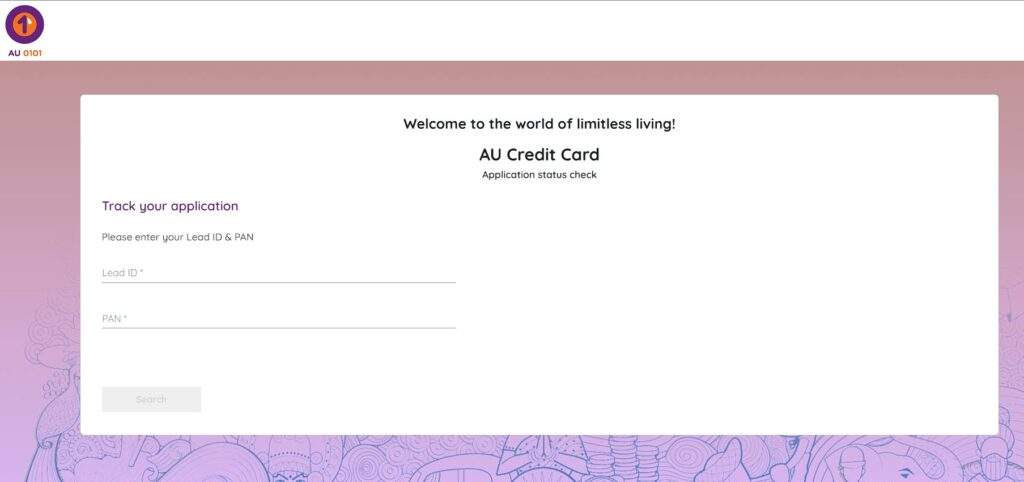

Open a web browser and visit the AU Bank Credit Card Application Status Tracker: https://cconboarding.aubank.in/application_status/

This is the official portal to check your application’s progress.

2 Step: Locate Your Credentials

Before heading to the webpage, gather your application confirmation email or SMS. You’ll need two pieces of information from it: Application Lead ID and PAN.

- Lead ID: This unique number is found in your application confirmation email or SMS.

- PAN (Permanent Account Number): Your 10-digit tax identification number.

Benefits of Using Lead ID & PAN:

- Quick and Convenient: No need for phone calls or additional information.

- Readily Available Information: You likely already have your Lead ID and PAN after applying.

3 Step: Enter Your Credentials

On the webpage, you’ll find sections for “Lead ID” and “PAN.” Carefully enter your Lead ID Next, enter your PAN.

Be sure to enter both details exactly as they appear in your confirmation message to ensure accurate results.

4 Step: Click and See Your Status

Once you’ve entered both your Lead ID and PAN, click the “Search” button. The webpage will then display your current application status. It could be:

- Approved: Congratulations! Your new credit card is on its way and will be delivered within 3 to 10 business days.

- Under Processing: Be patient, an update is expected soon. AU Bank is still reviewing your application.

- Declined: AU Bank will inform you via email or SMS if your application is declined, explaining the reason for the decision.

Alternative Method (If Required)

Check the Status with the Service Request Number (SRN)

While AU Bank’s website might not offer a direct way to check with SRN, you can still get your status update: Call their toll-free number 1800 1200 1500 and provide your SRN to a customer service representative. They can access your application and update you on the status.

What to Remember About Using SRN:

- Less Convenient: This method requires a phone call, unlike the Lead ID & PAN method.

- Have Your Information Ready: Be prepared to provide your SRN or any other relevant details to the customer service representative when you call.

Additional Tips:

- Check Email: Keep an eye on your email for updates from AU Bank.

- Visit the Branch: If you applied in person, visit your local AU Bank branch for assistance.

FAQs

What if I don’t have my Lead ID or PAN?

You can contact AU Bank customer care (number above) and they can help you find your application details.

How long does it take to get a decision on my application?

Typically, it takes 1-2 weeks, but the status tracker will give you updates.

Can I reapply if my application is declined?

Yes, but it’s recommended to address the reason for the decline mentioned in the email/SMS from AU Bank before reapplying.

What documents do I typically need to submit with my application?

While requirements might change, common documents include ID proof, address proof, income proof (salary slips/bank statements), and PAN card copy. You can find the latest requirements on the AU Bank credit card application page.

Can I track my application if I applied through a third-party website?

No, the methods above are for applications submitted directly through AU Bank. If you applied through a third party, they might have their tracking process. Contact them for details.

What are some reasons my application might be declined?

Common reasons include insufficient income, low credit scores, negative credit history, or incomplete application information. AU Bank will provide the specific reason for your decline.

How can I improve my chances of getting approved next time?

Maintain a good credit score, ensure stable income, and avoid multiple applications. Consider a lower credit limit for a limited credit history. Check credit card eligibility here for approval chances.